Married couples filing jointly & surviving spouses Single filers & Married couples filing separately However, the total can’t exceed the basic standard deduction for your filing status.

#Nebraska tax brackets 2022 plus#

co3Uhsp0Js- Raymond James March 7, 2022Īlso, the standard deduction will increase in 2022 by $400 to $12,950 for single filer or married but filing separately, by $600 to $19,400 for head of households and $800 to $25,900 for married taxpayers filing jointly.Īn additional standard deduction of $1,400 will apply to those who are either 65 and older or blind, and the amount doubles if both apply to a taxpayer in 2022.ĭependents that can be claimed on another person’s tax return for the 2022 fiscal year are limited to a standard deduction of either $1,150 or your earned income plus $400, whichever is greater. Here’s a look at two of them in preparation for #TaxDay.

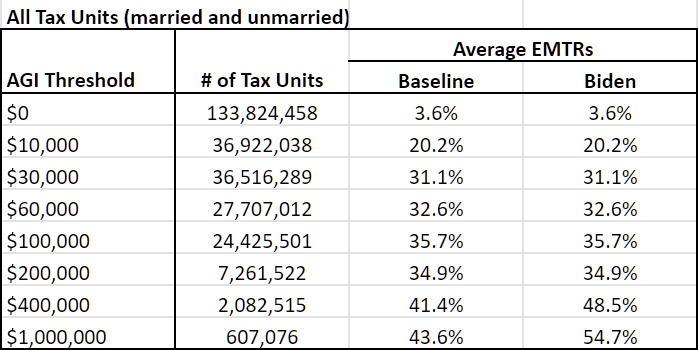

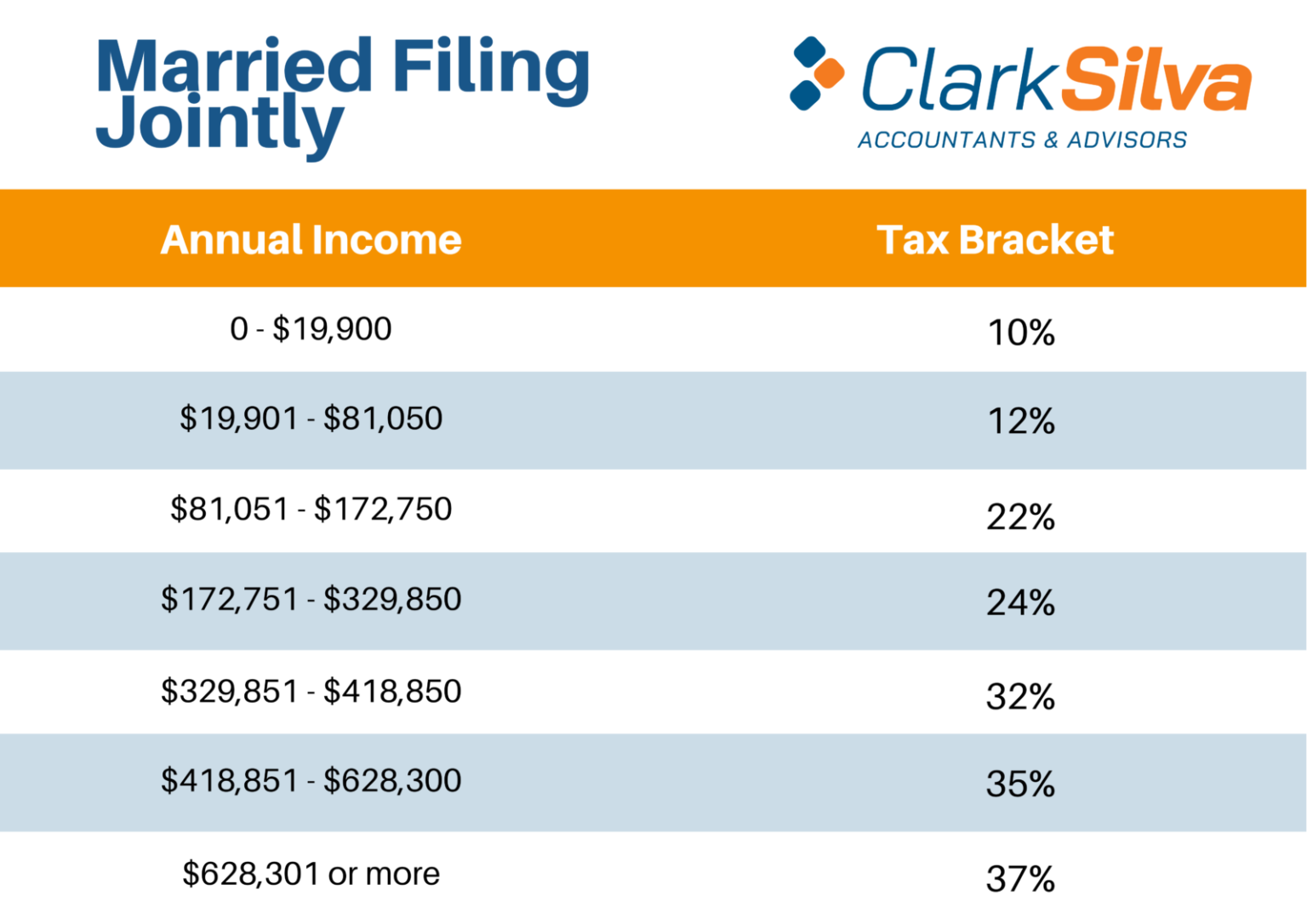

Not only can an extra dollar push you into the next highest tax bracket, but it can also affect your exposure to certain surtaxes. So, for example instead of 10% being applied to the first $9,950 of income, it will now be applied to the first $10,275 for a taxpayer filing individually. The annual adjustment is designed to avoid “bracket creep”, when people are pushed into a higher income bracket or inflation reduces the value of other deductions or credits. This is based on the Chained Consumer Price Index created by the Bureau of Labor Statistics through continuously tracking the changing price of a basket of goods and consumer purchasing behavior in response to that change. However, the income thresholds for tax brackets are adjusted to reflect inflation or the cost of living. The seven brackets remain the same 10%, 12%, 22%, 24%, 32%, 35% and 37% which were set after the 2017 Tax Cuts and Jobs Act.

#Nebraska tax brackets 2022 how to#

Student Loan Relief Forgiveness Application: how does it works and how to apply?.VA disability and military retirement COLA 2023 adjustment.Social Security COLA 2023: How much will benefits increase next year?.

Medicare Premiums Part B: How much will it cost in 2023.While the official Form 1040 hasn’t been released yet, the IRS posted a draft version in July.

Taxpayers can use this data to help plan ahead for their tax liability in the coming year to avoid having a surprise bill from Uncle Sam. The adjustment announced by the IRS last year affects more than 60 tax provisions and took effect 1 January 2022, so they did not apply to the 2021 tax returns. Those filing tax returns will want to know how much they will be taxed on their earnings and to help in this endeavour, the IRS adjusts tax provisions and tax brackets every year to account for inflation to avoid what is known as “bracket creep.” The percentages that Americans are taxed in the seven tax brackets remained the same for 2022, but income level thresholds that determine which one you fall into were raised from 2021 levels. The date has come and passed on 17 October, but keeping track of what you owe to the IRS is a year round affair to keep your records in order to avoid a last-minute scramble to find them. A record number of American taxpayers filed for an extension on their 2021 tax filings.

0 kommentar(er)

0 kommentar(er)